Some Ideas on Custom Private Equity Asset Managers You Should Know

You've most likely come across the term private equity (PE): spending in companies that are not openly traded. Approximately $11. 7 trillion in assets were managed by exclusive markets in 2022. PE companies look for opportunities to make returns that are better than what can be attained in public equity markets. There may be a couple of things you don't comprehend regarding the market.

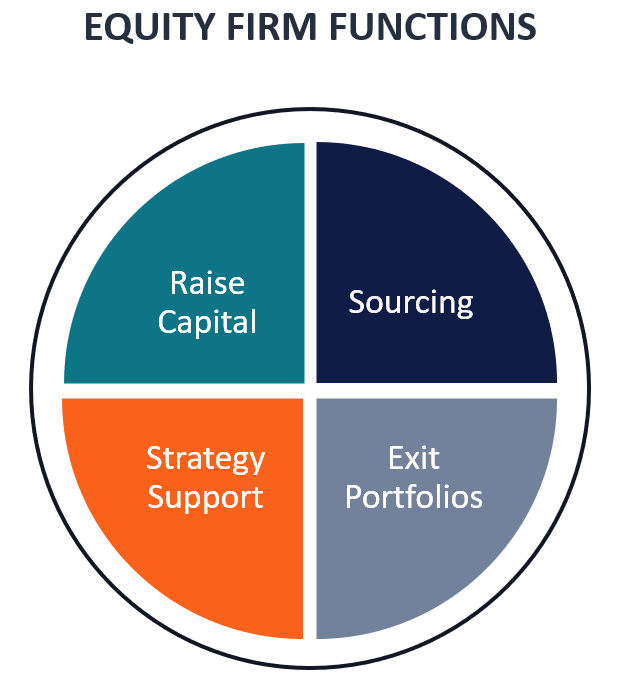

Partners at PE companies raise funds and take care of the money to generate beneficial returns for shareholders, generally with an investment horizon of in between four and seven years. Exclusive equity firms have a range of financial investment preferences. his comment is here Some are rigorous financiers or passive investors completely depending on administration to grow the firm and produce returns.

Because the most effective gravitate towards the bigger offers, the center market is a dramatically underserved market. There are much more vendors than there are extremely skilled and well-positioned money professionals with comprehensive customer networks and sources to manage a deal. The returns of personal equity are commonly seen after a few years.

Not known Facts About Custom Private Equity Asset Managers

Traveling below the radar of huge international firms, many of these small business typically supply higher-quality client solution and/or specific niche items and solutions that are not being supplied by the big empires (https://cpequityamtx.creator-spring.com). Such upsides draw in the interest of exclusive equity companies, as they possess the understandings and wise to manipulate such opportunities and take the business to the following degree

A lot of managers at profile business are offered equity and bonus compensation frameworks that award them for hitting their economic targets. Private equity chances are typically out of reach for individuals who can't invest millions of dollars, but they shouldn't be.

There are regulations, such as limits on the aggregate quantity of money and on the variety of non-accredited financiers. The personal equity company brings in several of the finest and brightest in corporate America, including leading entertainers from Ton of money 500 business and elite administration consulting firms. Law office can likewise be recruiting premises for private equity works with, as accountancy and legal abilities are needed to full offers, and deals are very demanded. https://www.flickr.com/people/199656924@N04/.

What Does Custom Private Equity Asset Managers Do?

One more negative aspect is the absence of liquidity; as soon as in a personal equity purchase, it is not very easy to leave or sell. There is a lack of flexibility. Private equity additionally includes high charges. With funds under management already in the trillions, private equity companies have become attractive financial investment cars for well-off individuals and institutions.

Now that access to personal equity is opening up to more private financiers, the untapped potential is becoming a reality. We'll begin with the primary debates for spending in personal equity: Just how and why private equity returns have actually historically been higher than various other properties on a number of levels, Just how consisting of personal equity in a profile influences the risk-return account, by aiding to diversify against market and intermittent threat, Then, we will describe some essential considerations and dangers for personal equity financiers.

When it pertains to introducing a brand-new property right into a profile, the a lot of fundamental factor to consider is the risk-return account of that possession. Historically, personal equity has shown returns comparable to that of Emerging Market Equities and greater than all various other standard asset courses. Its relatively reduced volatility combined with its high returns creates an engaging risk-return profile.

Facts About Custom Private Equity Asset Managers Uncovered

Private equity fund quartiles have the largest array of returns across all different asset classes - as you can see listed below. Approach: Inner rate of return (IRR) spreads calculated for funds within vintage years individually and afterwards balanced out. Typical IRR was calculated bytaking the standard of the typical IRR for funds within each vintage year.

The impact of including personal equity into a profile is - as constantly - dependent on the profile itself. A Pantheon study from 2015 recommended that consisting of private equity in a portfolio of pure public equity can unlock 3.

On the other hand, the very best private equity firms have access to an even larger pool of unknown possibilities that do not deal with the very same analysis, in addition to the sources to perform due diligence on them and identify which are worth purchasing (Syndicated Private Equity Opportunities). Spending at the very beginning implies higher risk, yet for the business that do prosper, the fund advantages from greater returns

9 Easy Facts About Custom Private Equity Asset Managers Described

Both public and personal equity fund supervisors commit to investing a percent of the fund yet there stays a well-trodden concern with lining up passions for public equity fund monitoring: the 'principal-agent issue'. When a capitalist (the 'principal') works with a public fund supervisor to take control of their funding (as an 'agent') they pass on control to the supervisor while preserving possession of the assets.

In the case of exclusive equity, the General Partner does not just make a monitoring cost. Personal equity funds additionally reduce one more type of principal-agent problem.

A public equity financier ultimately wants one point - for the administration to enhance the supply cost and/or pay out dividends. The financier has little to no control over the choice. We revealed above the number of personal equity techniques - especially bulk buyouts - take control of the running of the firm, making sure that the long-term worth of the business precedes, rising the roi over the life of the fund.